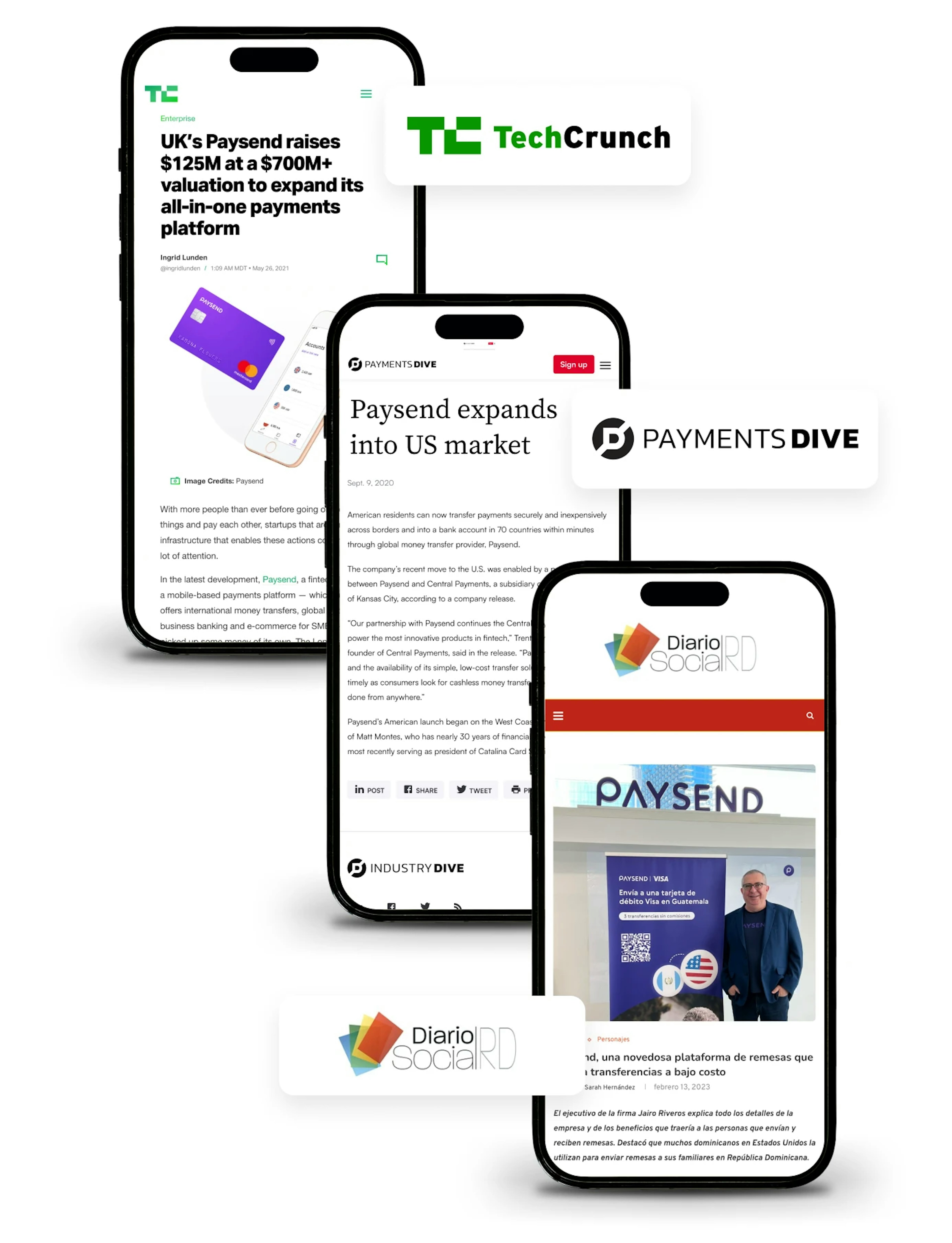

After its debut in the U.S., Paysend quickly gained momentum in the Americas, enabling the money transfer provider to close a $125M Series B. To publicize the news, Alloy architected an aggressive media relations strategy that targeted U.S. tier-1 media and the cascaded to other countries. The morning of the announcement, an exclusive ran in TechCrunch touting Paysend’s product differentiators, and less than 24 hours later, the news was covered in 41 U.S.-based publications such as Yahoo Finance!, Axios, Fortune, PYMNTS.com Finextra, Finovate, Digital Transactions and Debanked — reaching customer targets and making global waves.

By creating a PR and content-driven go-to-market strategy, Alloy enabled Paysend to gain critical mindshare and marketshare in the Americas.

A foundational PR program

Alloy created a PR program focused on gaining credibility in the U.S. FinTech industry by targeting global payment and banking publications. The program also introduced Paysend’s stateside banking partner and newly appointed SME to bolster credibility. At the same time, Alloy wanted to build integrity with new users, so we took a consumer-oriented angle and announced that Paysend would offer zero-fee transfers for U.S. customers — targeting immigrant and expatriate communities to drive app downloads. In the first 30 days, Alloy secured 18 media placements — driving app downloads and referral traffic to the site. A few weeks later, Paysend broke out of trade publications, landing its first American Tier 1 story in U.S. News & World Report.

Increased visibility with key demographics

To further drive visibility, Alloy architected a content marketing strategy that celebrated holidays and events across a number of different cultures. To ensure it increased online engagement, Alloy weaved in country-specific search keywords into every blog post. The U.S. content campaign gave Paysend immediate online visibility and reach. In fact, the site ranked for nearly 25% of its priority keywords and improved ranking for certain keywords by 120 positions in the first month.

Expansion into LATAM

Paysend wanted to enter the LATAM market quickly in order to cement itself as the No. 1 remittance service provider in the region. Alloy replicated its U.S. go-to-market framework, but modified its PR and content marketing strategy for Mexico, Central America and South America. At the heart of the plan was an educational component that positioned Paysend as an expert on financial challenges affecting Latin American populations to build trust and credibility. In less than a year, Paysend appeared in multiple top-tier publications for the first time, including Semana, La Republica, LatAm Fintech News and El Nuevo Herald — reaching both South American consumers and migrant U.S workers. The PR boost, combined with social media and content marketing activations, increased Paysend’s web traffic from Latin America and the Caribbean by 186% year over year, supporting its global expansion into the key region.

"Alloy is a PR powerhouse, constantly coming up with creative, thorough ways to expand our thought leadership and coverage in regions throughout the Americas."

— Alan Duerden, Head of Brand, PR and Communications at Paysend